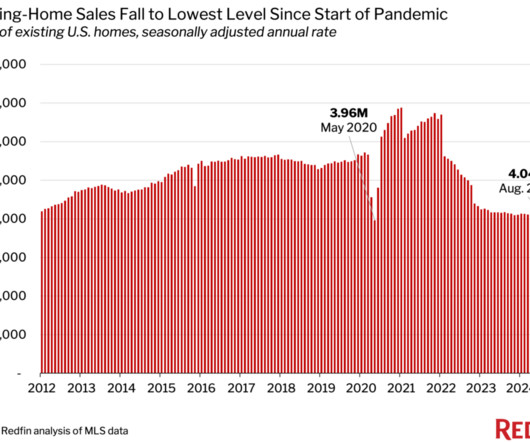

New listings data is growing and prices still aren’t crashing

Housing Wire

JUNE 29, 2024

The rules of supply and demand economics always end up winning and weekly new listing data is key. New listing data is growing year over year, but it will be the second-lowest new listing data ever recorded in history. With more sellers who are buyers, we have a tad more demand this year.

Let's personalize your content