Lower mortgage rates are stabilizing the housing market

Housing Wire

DECEMBER 7, 2022

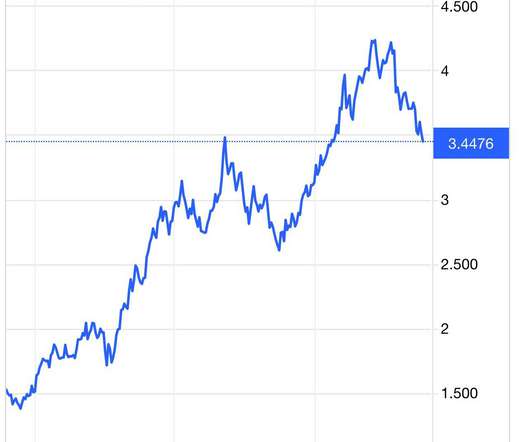

One issue that has created a waterfall dive in purchase application data and sales is that new listing data is declining faster than usual. Traditionally, when mortgage rates rise post-2012, home sales trend below 5 million. That’s a double whammy on demand and a reason for the waterfall in existing home sales data.

Let's personalize your content