Comparing this housing market recession to 2008

Housing Wire

DECEMBER 29, 2022

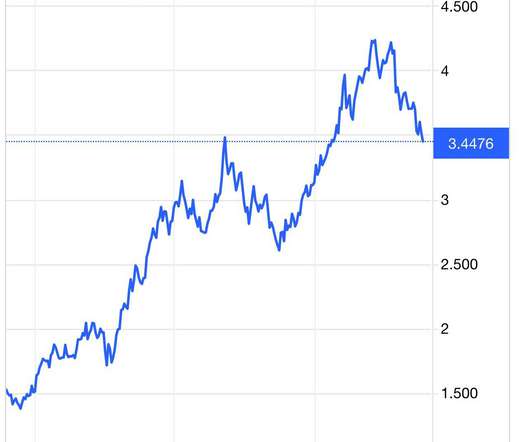

As we close out 2022, it’s time to reflect on a historic year for the housing market, which was even crazier than the COVID-19 year of 2020. A few months ago, I was asked to go on CNBC and talk about why I call this a housing recession and why this year reminds me a lot of 2018, but much worse on the four items above.

Let's personalize your content