Single-family housing starts reach highest level since 2007

Housing Wire

DECEMBER 17, 2020

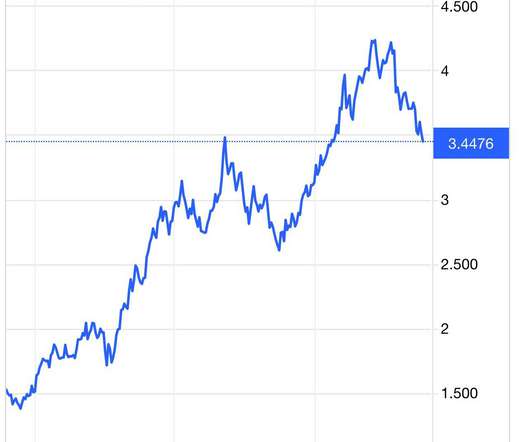

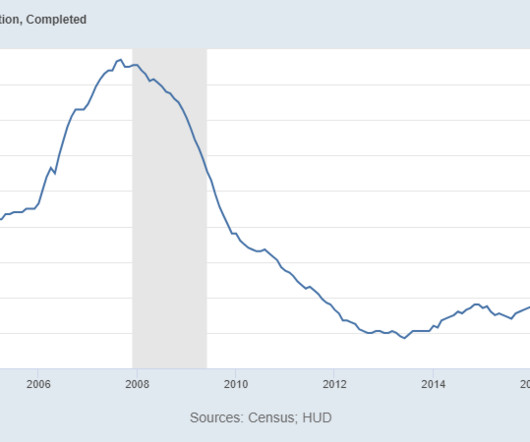

Single-family housing starts continued their seven-month climb in November, coming in at the highest level since 2007, according to the Census Bureau. Additionally, permits for new single-family construction also rose to 2007 highs, potentially an indication that we might see the increase in homebuilding continue into early 2021,“ Kan said.

Let's personalize your content