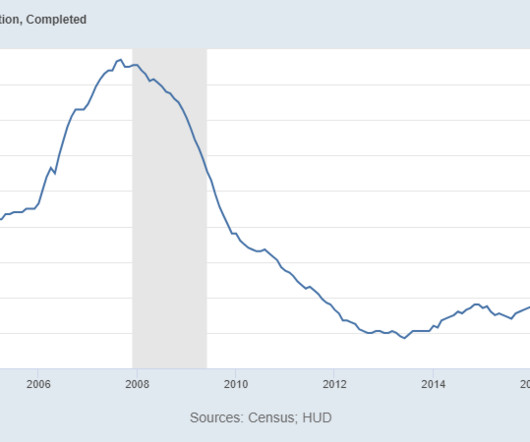

Single-family housing starts reach highest level since 2007

Housing Wire

DECEMBER 17, 2020

Single-family housing starts continued their seven-month climb in November, coming in at the highest level since 2007, according to the Census Bureau. As a result of the pandemic, there has been a heightened demand for larger homes, which Kan said has driven more construction, home sales and mortgage originations. million starts.

Let's personalize your content