Single-family housing starts reach highest level since 2007

Housing Wire

DECEMBER 17, 2020

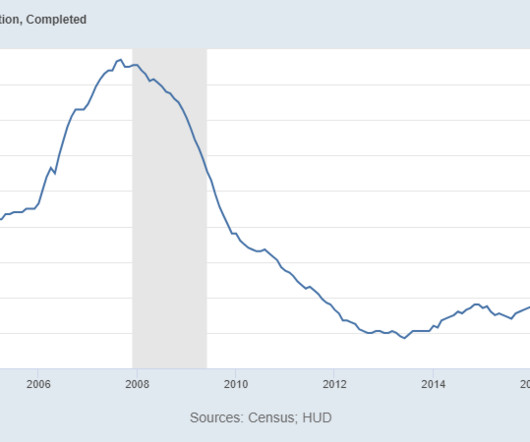

Single-family housing starts continued their seven-month climb in November, coming in at the highest level since 2007, according to the Census Bureau. Housing starts rose 1.2% Single-family housing starts rose 0.4% How the mortgage industry is working together to make housing more affordable. million starts.

Let's personalize your content