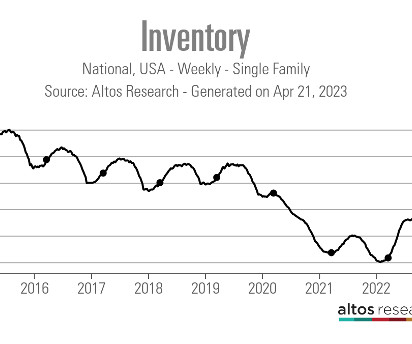

Lower mortgage rates are stabilizing the housing market

Housing Wire

DECEMBER 7, 2022

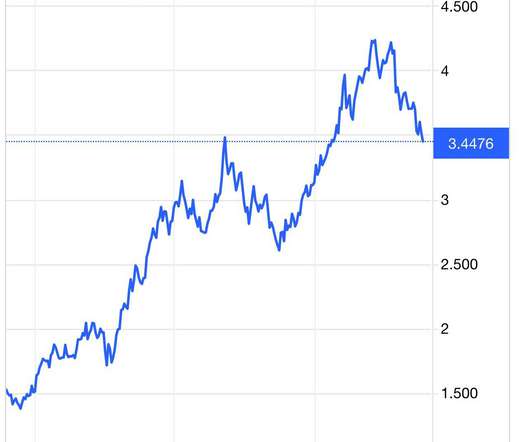

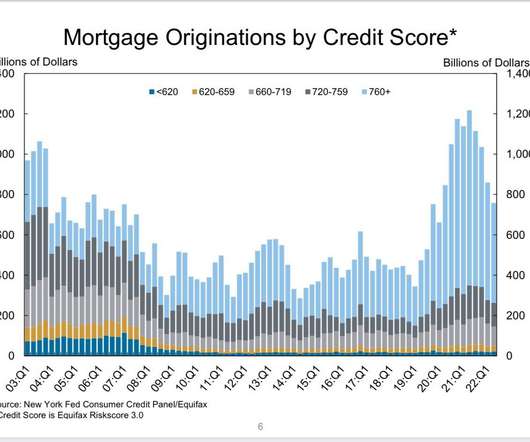

Since the weaker CPI data was released in November, bond yields and mortgage rates have been heading lower. The question then was: What would lower mortgage rates do to this data? However, mortgage rates have fallen more than 1% since the recent highs, so it’s time to look at the data to explain how to interpret it.

Let's personalize your content