Lower mortgage rates are stabilizing the housing market

Housing Wire

DECEMBER 7, 2022

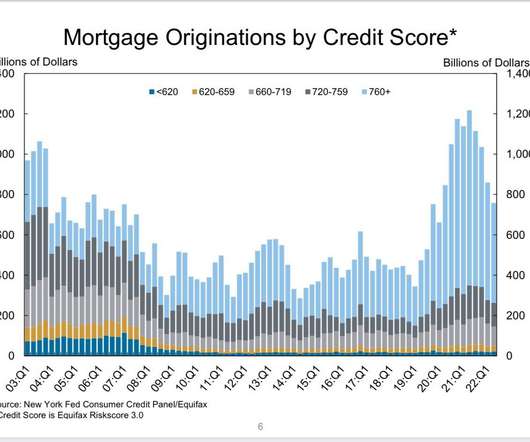

What I mean by a credit bust is that after the housing bubble burst in 2005 into 2006, we saw a massive increase in supply. These were forced credit sellers, which means these sellers don’t sell to buy a home like a traditional seller does. Total inventory levels. NAR: Total Inventory levels 1.22

Let's personalize your content