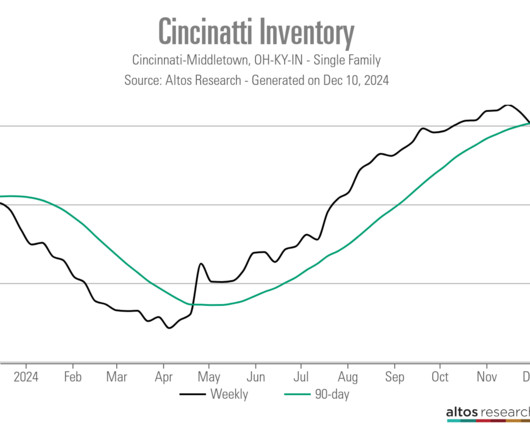

Housing inventory is down 40%. Buyers are paying the price

Housing Wire

APRIL 5, 2021

Instead of making up for the shortfall, new listings have slumped further in 2021. Year-over-year, new listing volumes were down 16% in January and 21% in February — amounting to a 125,000 deficit in inventory compared to the same time in 2020. year-over-year in January, the most growth in a single year since 2005.

Let's personalize your content