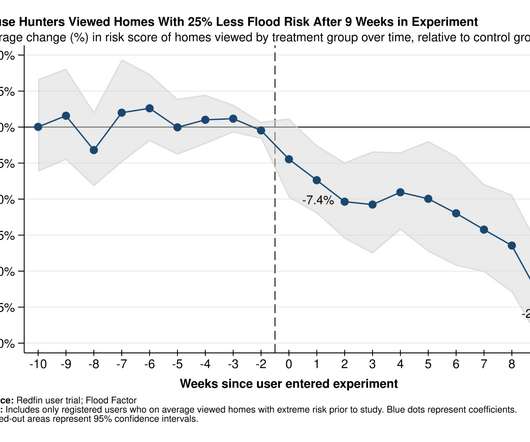

Home prices are still rising, but relief for buyers is coming

Housing Wire

AUGUST 3, 2021

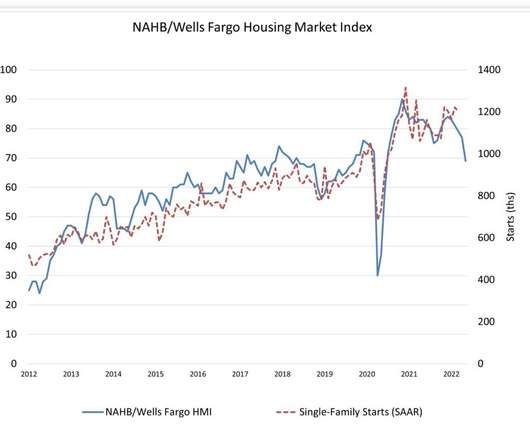

But relief for buyers could be coming in the next 12 months. gain by this time next year, as ongoing affordability challenges deter potential buyers — as well as an uptick in new for sale listings. An index of 100 is equal to the average level of contract activity during 2001, the first year examined. Home prices increased 2.3%

Let's personalize your content