Housing market stays hot into fall with mortgage applications up 6.8%

Housing Wire

SEPTEMBER 23, 2020

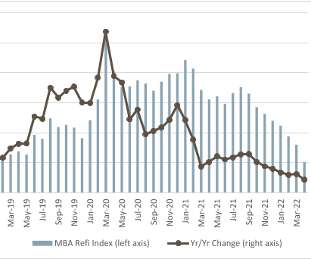

Despite mortgage rates rising slightly from a previously all-time low, mortgage applications gained 6.8% last week, according to a report from the Mortgage Bankers Association. Refinances also nearly reached two thirds share of mortgage activity last week, increasing to 64.3% of total applications from 62.8% from 3.07%.

Let's personalize your content