The standoff between homebuyers and sellers

Housing Wire

OCTOBER 11, 2022

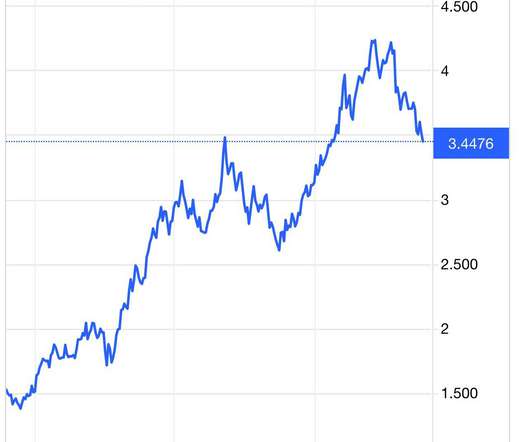

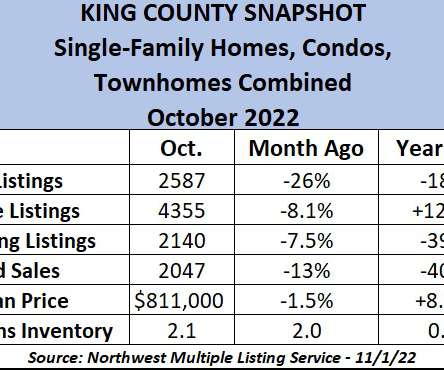

There’s a showdown at the housing market corral between homebuyers and sellers. To top it all off, we started 2022 at all-time lows, forcing bidding action everywhere until mortgage rates rose. And we aren’t talking about your grandfather’s mortgage rates rising; we went from 2.5% Image by Brandon Johnson/HW Media.).

Let's personalize your content