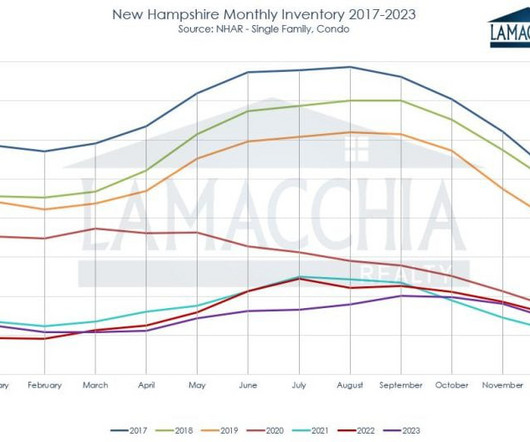

Are new home sales flagging a recession?

Housing Wire

MAY 24, 2022

I know some people don’t agree with me on this, but the price gains in both the existing home and new home sales sector show that homebuilders and sellers had too much pricing power and needed to be checked. Census Bureau and the Department of Housing and Urban Development. The only way this happens is by higher rates. This is 16.6

Let's personalize your content