Homebuilders are done until mortgage rates fall

Housing Wire

AUGUST 16, 2022

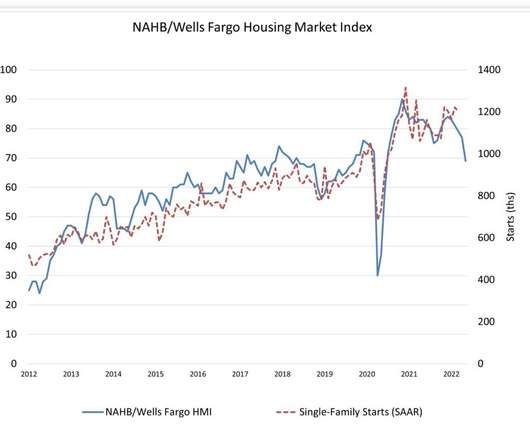

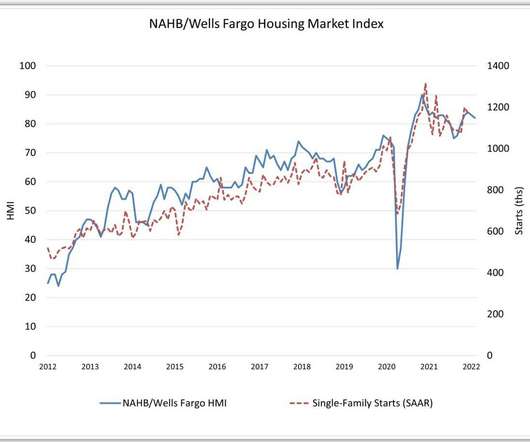

Tuesday’s housing starts report clearly shows that homebuilders are going to be done with single-family construction until mortgage rates fall. If it wasn’t for solid rental demand boosting multifamily construction this year — 18% year to date —this data line would have looked much worse.

Let's personalize your content