Pending home sales rise again as buyers capitalize on more inventory

Housing Wire

DECEMBER 30, 2024

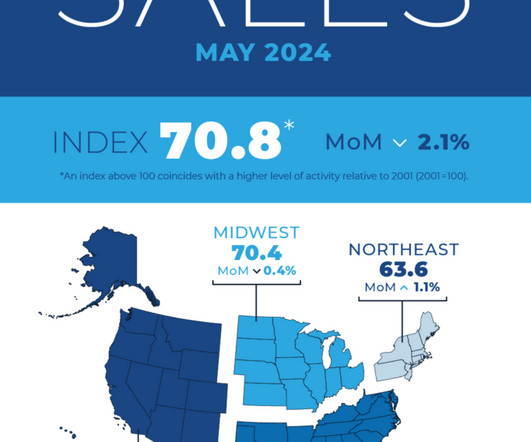

Despite rising mortgage rates through much of 2024, recent indications show growing boldness among homebuyers heading into the new year. The index is benchmarked to 100 in 2001 and is moving closer to what could be regarded as normal levels of home sales activity. These increases are persisting despite mortgage rates near 7%.

Let's personalize your content