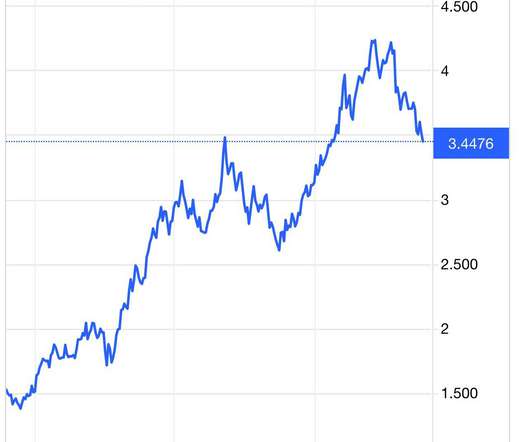

Mortgage rates surge to highest level since 2000

Housing Wire

SEPTEMBER 28, 2023

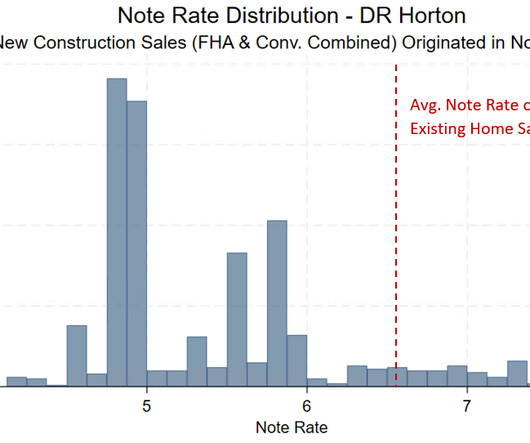

Mortgage rates climbed again this week as investors braced themselves for ‘higher-for-longer’ conditions following last week’s Fed meeting. By contrast, the 30-year fixed-rate mortgage was at 6.70% a year ago at this time. Other indices showed significantly higher mortgage rates this week. on September 27 from 4.3% a week prior.

Let's personalize your content