House flipping hits lowest level since 2000

Housing Wire

JUNE 18, 2021

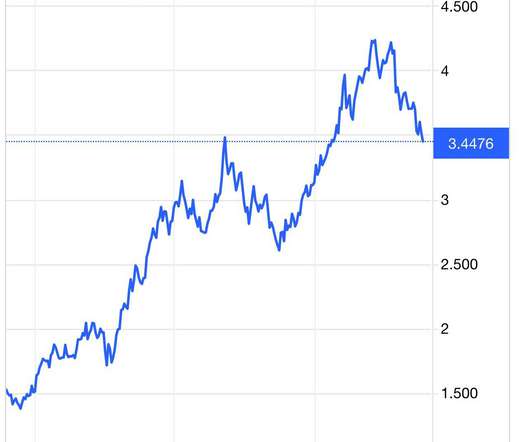

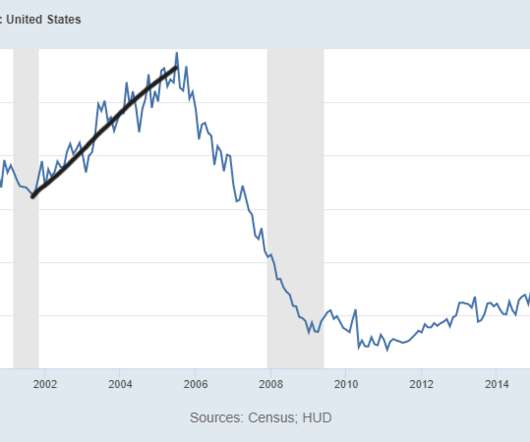

of all home sales in the first quarter of 2021 were flips — or one in 37 transactions, the lowest level since 2000. Regionally, house flipping was down in 70 percent of U.S. How fix’n’flip loans could help expand housing inventory. The post House flipping hits lowest level since 2000 appeared first on HousingWire.

Let's personalize your content