House flipping hits lowest level since 2000

Housing Wire

JUNE 18, 2021

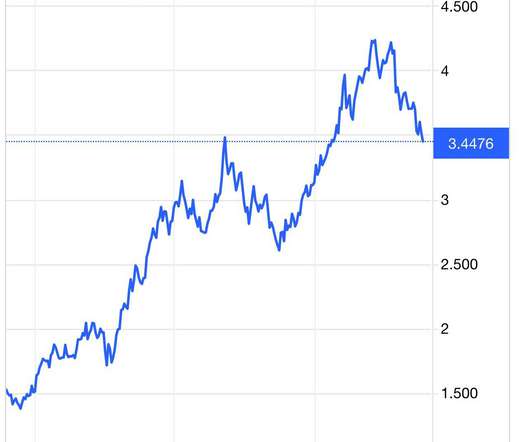

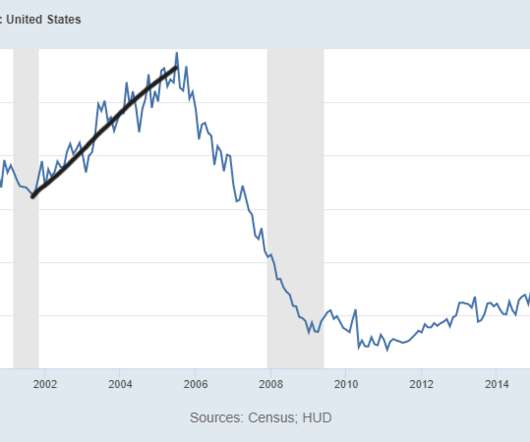

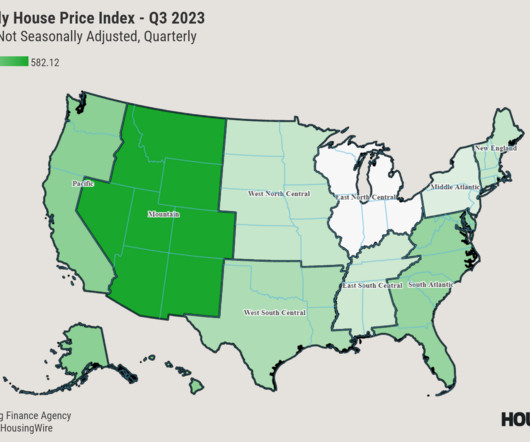

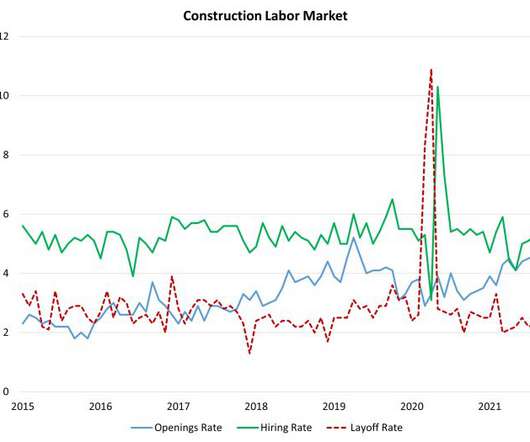

of all home sales in the first quarter of 2021 were flips — or one in 37 transactions, the lowest level since 2000. How fix’n’flip loans could help expand housing inventory. The market is tight, prices are soaring on what stock is available and it’s not available long. were flipped in the first quarter.

Let's personalize your content