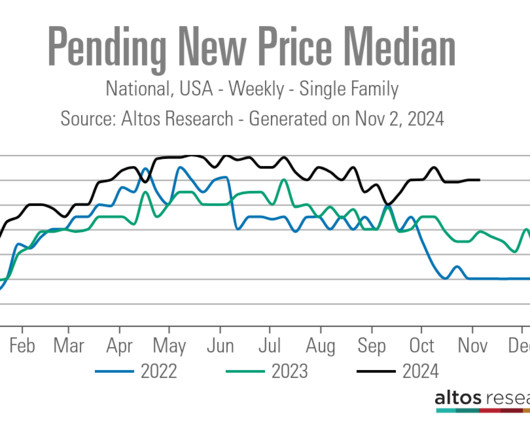

As mortgage rates hit a two-decade high, mortgage applications tick down

Housing Wire

SEPTEMBER 27, 2023

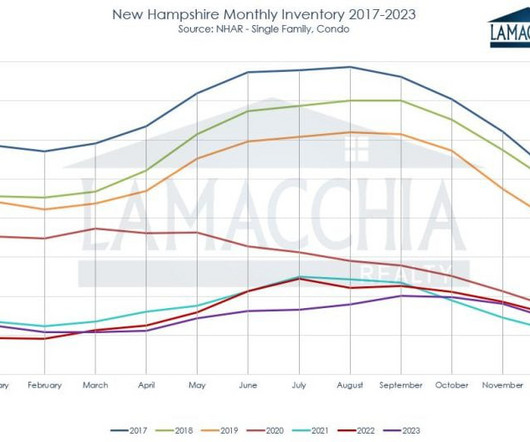

It is still facing limited for-sale inventory and struggling with affordability issues. The average contract interest rate for 5/1 ARMs picked up to 6.47% from 6.42% a week prior. Based on the FOMC’s most recent projections, rates are expected to be higher for longer, which has driven Treasury yields to new heights. Lastly, the U.S.

Let's personalize your content