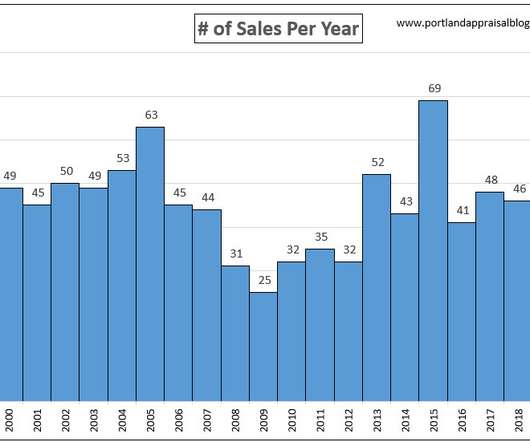

Mortgage apps decline 2.3% to the lowest level since 2000

Housing Wire

AUGUST 17, 2022

Demand for mortgage loans declined to the lowest level since 2000 last week due to affordability challenges and uncertainties regarding the U.S. decline from the previous week and fell 82% from the same week in 2021 to its lowest level since November 2000, driven by a 6% drop in conventional refi applications. for the week ending Aug.

Let's personalize your content